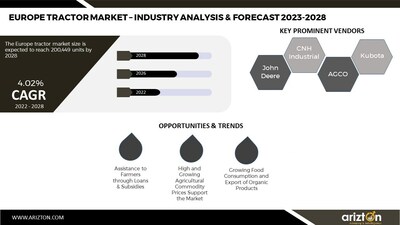

Arizton Estimates the Sale of Tractors to Reach 200 thousand Units in Europe by 2028. John Deere, CNH Industrial, AGCO, and Kubota are the Major Vendors. Demand for 50-100 HP Tractors Likely to Increase

· Growing Food Consumption and Export of Organic Products=

Click Here to Download the Free Sample Report

Impact of Assistance to Farmers through Loans & Subsidies

Agriculture is a major source of income for the European economy. Therefore, the government sustains and empowers farmers. Europe also encourages new farmers by providing additional support through the CAP's direct payment policy. European countries must set aside 2% of their allocated direct payment funding to provide younger farmers with a 25% bonus during the first few years. Moreover, younger farmers are prioritized while receiving direct payment funding from the national and regional governments. The government in some European countries runs several agricultural schemes, and the younger generation of farmers takes advantage of the same. The Rural Development Programme of the Europe Productivity Scheme provides funding for projects in the country that improve productivity in the farming and forestry sectors and helps create jobs and growth in rural areas.

Market Trends & Opportunities

Increasing Use of Bioenergy in Tractors

Farmers typically used diesel-powered tractors because of their high power. Due to improvements in engine technology, fuel efficiency, and machine technologies, tractors are now more effective and can complete tasks with less power. Farmers' ability to manage their budgets is hampered by the fluctuation in diesel prices. Several brand-new, state-of-the-art models of agricultural machinery can already be powered by farm-produced bio-based energy.

Technological Advance in Tractor Technology

As agriculture and digital technology came together, a new frontier of innovation emerged, opening numerous avenues for a smart agricultural future in the European tractor market. Tractor manufacturers are competitive, and companies constantly strive to innovate and ensure product differentiation at affordable prices. Modern tractors built with cutting-edge technology are currently on the market. GPS and remote sensing make farming more accurate and productive.

Why Should You Buy This Report?

This Europe tractor market report is among the few in the market that offer outlook and opportunity analyses forecast in terms of:

Key Vendors

Market Segmentation

Horsepower

Drive Type

Geography

Click Here to Download the Free Sample Report

Table of Content

1 RESEARCH METHODOLOGY

2 RESEARCH OBJECTIVES

3 RESEARCH PROCESS

4 SCOPE & COVERAGE

4.1 MARKET DEFINITION

4.1.1 INCLUSIONS

4.1.2 EXCLUSIONS

4.1.3 MARKET ESTIMATION CAVEATS

4.2 BASE YEAR

4.3 SCOPE OF THE STUDY

5 REPORT ASSUMPTIONS & CAVEATS

5.1 KEY CAVEATS

5.2 CURRENCY CONVERSION

5.3 MARKET DERIVATION

6 MARKET AT A GLANCE

7 PREMIUM INSIGHTS

8 INTRODUCTION

8.1 OVERVIEW

8.2 VALUE CHAIN ANALYSIS

8.2.1 OVERVIEW

8.2.2 RAW MATERIAL & COMPONENT SUPPLIERS

8.2.3 MANUFACTURERS

8.2.4 DEALERS/DISTRIBUTORS

8.2.5 RETAILERS

8.2.6 END-USERS

8.3 COMMON AGRICULTURAL POLICY & EU AGRICULTURAL EXPENDITURE

8.4 INCREASING ADOPTION OF PRECISION FARMING

8.5 TECHNOLOGICAL ADVANCES

9 MARKET OPPORTUNITIES & TRENDS

9.1 TECHNOLOGICAL ADVANCES IN TRACTOR TECHNOLOGY

9.1.1 GPS TECHNOLOGY

9.1.2 HIGH DEMAND FOR AUTONOMOUS OR SELF-DRIVING TRACTORS

9.2 SHORTAGE OF AGRICULTURAL LABORERS

9.3 INCREASING USE OF BIOENERGY IN AGRICULTURAL MACHINERY

10 MARKET GROWTH ENABLERS

10.1 ASSISTANCE TO FARMERS THROUGH LOANS & SUBSIDIES

10.2 STRONG AGRICULTURAL COMMODITY PRICES SUPPORT MARKET

10.3 GROWING FOOD CONSUMPTION & EXPORT OF ORGANIC PRODUCTS

11 MARKET GROWTH RESTRAINTS

11.1 LACK OF AWARENESS OF LATEST AGRICULTURAL EQUIPMENT INNOVATIONS

11.1.1 LACK OF EDUCATION AMONG FARMERS

11.2 HIGH DEMAND FOR USED & RENTAL TRACTORS

11.3 CLIMATE CHANGE ADVERSELY IMPACTING AGRICULTURAL ACTIVITIES

12 MARKET LANDSCAPE

12.1 MARKET OVERVIEW

12.2 MARKET SIZE & FORECAST

12.3 FIVE FORCES ANALYSIS

12.3.1 THREAT OF NEW ENTRANTS

12.3.2 BARGAINING POWER OF SUPPLIERS

12.3.3 BARGAINING POWER OF BUYERS

12.3.4 THREAT OF SUBSTITUTES

12.3.5 COMPETITIVE RIVALRY

13 BY HORSEPOWER

13.1 MARKET SNAPSHOT & GROWTH ENGINE

13.2 MARKET OVERVIEW

13.3 LESS THAN 50 HP

13.3.1 MARKET OVERVIEW

13.3.2 MARKET SIZE & FORECAST

13.3.3 MARKET BY GEOGRAPHY

13.4 50 HP-100 HP

13.4.1 MARKET OVERVIEW

13.4.2 MARKET SIZE & FORECAST

13.4.3 MARKET BY GEOGRAPHY

13.5 ABOVE 100 HP

13.5.1 MARKET OVERVIEW

13.5.2 MARKET SIZE & FORECAST

13.5.3 MARKET BY GEOGRAPHY

14 BY WHEEL-DRIVE

14.1 MARKET SNAPSHOT & GROWTH ENGINE

14.2 MARKET OVERVIEW

14.3 2-WHEEL-DRIVE

14.3.1 MARKET OVERVIEW

14.3.2 MARKET SIZE & FORECAST

14.3.3 MARKET BY GEOGRAPHY

14.4 4-WHEEL-DRIVE

14.4.1 MARKET OVERVIEW

14.4.2 MARKET SIZE & FORECAST

14.4.3 MARKET BY GEOGRAPHY

15 GEOGRAPHY

15.1 MARKET SNAPSHOT & GROWTH ENGINE

15.2 GEOGRAPHIC OVERVIEW

15.3 FRANCE

15.3.1 MARKET OVERVIEW

15.3.2 LAND HOLDING STRUCTURES IN FRANCE

15.3.3 MARKET SIZE & FORECAST

15.3.4 BY HORSEPOWER

15.3.5 BY WHEEL-DRIVE

15.3.6 MARKET SHARE ANALYSIS

15.4 GERMANY

15.4.1 MARKET OVERVIEW

15.4.2 LAND HOLDING STRUCTURES IN GERMANY

15.4.3 MARKET SIZE & FORECAST

15.4.4 BY HORSEPOWER

15.4.5 BY WHEEL-DRIVE

15.4.6 MARKET SHARE ANALYSIS

15.5 ITALY

15.5.1 MARKET OVERVIEW

15.5.2 LAND HOLDING STRUCTURES IN ITALY

15.5.3 MARKET SIZE & FORECAST

15.5.4 BY HORSEPOWER

15.5.5 BY WHEEL-DRIVE

15.5.6 MARKET SHARE ANALYSIS

15.6 UK

15.6.1 MARKET OVERVIEW

15.6.2 BREXIT IMPACT ON UK AGRICULTURAL INDUSTRY

15.6.3 LAND HOLDING STRUCTURE IN UK

15.6.4 MARKET SIZE & FORECAST

15.6.5 BY HORSEPOWER

15.6.6 BY WHEEL-DRIVE

15.6.7 MARKET SHARE ANALYSIS

15.7 POLAND

15.7.1 MARKET OVERVIEW

15.7.2 LAND HOLDING STRUCTURES IN POLAND

15.7.3 MARKET SIZE & FORECAST

15.7.4 BY HORSEPOWER

15.7.5 BY WHEEL-DRIVE

15.7.6 MARKET SHARE ANALYSIS

15.8 SPAIN

15.8.1 MARKET OVERVIEW

15.8.2 LAND HOLDING STRUCTURE IN SPAIN

15.8.3 MARKET SIZE & FORECAST

15.8.4 BY HORSEPOWER

15.8.5 BY WHEEL-DRIVE

15.8.6 MARKET SHARE ANALYSIS

15.9 OTHERS

15.9.1 MARKET OVERVIEW

15.9.2 MARKET SIZE & FORECAST

15.9.3 BY HORSEPOWER

15.9.4 BY WHEEL-DRIVE

15.9.5 MARKET SHARE ANALYSIS

16 COMPETITIVE LANDSCAPE

16.1 COMPETITION OVERVIEW

17 KEY COMPANY PROFILES

17.1 JOHN DEERE

17.1.1 BUSINESS OVERVIEW

17.1.2 JOHN DEERE IN AGRICULTURE TRACTOR MARKET

17.1.3 PRODUCT OFFERINGS

17.1.4 KEY STRATEGIES

17.1.5 KEY STRENGTHS

17.1.6 KEY OPPORTUNITIES

17.2 CNH INDUSTRIAL

17.3 AGCO

17.4 KUBOTA

18 OTHER PROMINENT VENDORS

18.1 ZETOR POLSKA SP. Z.O.O.

18.1.1 BUSINESS OVERVIEW

18.1.2 PRODUCT OFFERINGS

18.2 MAHINDRA & MAHINDRA

18.3 ESCORTS

18.4 JCB

18.5 FOTON

18.6 MTW HOLDINGS

18.7 SDF

18.8 ARBOS GROUP

18.9 YANMAR

19 REPORT SUMMARY

19.1 KEY TAKEAWAYS

19.2 STRATEGIC RECOMMENDATIONS

20 QUANTITATIVE SUMMARY

20.1 MARKET BY GEOGRAPHY

20.2 MARKET BY HORSEPOWER TYPE

20.3 MARKET BY WHEEL-DRIVE TYPE

21 APPENDIX

21.1 ABBREVIATIONS

Check Out Some of the Top-Selling Related Research Reports:

Spain Tractor Market - Industry Analysis & Forecast 2022-2028: The Spain tractor market is expected to reach 14,411 units by 2028 growing at a CAGR of 4.13% during the forecast period. In 2021, the 50-100 HP segment accounted for the largest market share based on horsepower.

Italy Tractor Market - Industry Analysis & Forecast 2022-2028: The Italy tractor market is expected to reach 31,531 units by 2027, growing at a CAGR of 3.74% from 2022 to 2028. Italy is Europe's third-largest tractor market. The export of tractors manufactured in Italy will witness growth as the prominent vendors adopt an export-centric approach to increase their net revenues. John Deere acquired the company "Beer Flag Robotics" in the year 2021 for $250 million to gain access to the advanced (autonomous driving technology) equipment market and expand to other countries by enhancing sales in Italy.

France Tractor Market - Industry Analysis & Forecast 2022-2028: France tractor market is expected to reach 39,213 units by 2028 growing at a CAGR of 4.24%. Tractors are the largest segment of France agriculture equipment market, accounting for less than 38% of the share. Tractors can be rightfully called the backbone of the France agriculture industry. Agriculture tractors accounted for 98% of the overall France tractors market in 2021. The Germany tractors market and France are the two biggest industries in the European region, and France is the 2nd largest market.

Germany Tractor Market - Industry Analysis & Forecast 2022-2028: The Germany Tractor market is expected to grow at a CAGR of 5.10%, from 31,925 units in 2021 to 45,219 units by 2028. Germany, a new frontier of innovation is emerging as agriculture meets digital technologies, opening various paths to a smart agricultural future. Smart agriculture will happen with the help of various technologies such as self-driving or autonomous tractors and GPS technology.

Table of Content

1 RESEARCH METHODOLOGY

2 RESEARCH OBJECTIVES

3 RESEARCH PROCESS

4 SCOPE & COVERAGE

4.1 MARKET DEFINITION

4.1.1 INCLUSIONS

4.1.2 EXCLUSIONS

4.1.3 MARKET ESTIMATION CAVEATS

4.2 BASE YEAR

4.3 SCOPE OF THE STUDY

5 REPORT ASSUMPTIONS & CAVEATS

5.1 KEY CAVEATS

5.2 CURRENCY CONVERSION

5.3 MARKET DERIVATION

6 MARKET AT A GLANCE

7 PREMIUM INSIGHTS

8 INTRODUCTION

8.1 OVERVIEW

8.2 VALUE CHAIN ANALYSIS

8.2.1 OVERVIEW

8.2.2 RAW MATERIAL & COMPONENT SUPPLIERS

8.2.3 MANUFACTURERS

8.2.4 DEALERS/DISTRIBUTORS

8.2.5 RETAILERS

8.2.6 END-USERS

8.3 COMMON AGRICULTURAL POLICY & EU AGRICULTURAL EXPENDITURE

8.4 INCREASING ADOPTION OF PRECISION FARMING

8.5 TECHNOLOGICAL ADVANCES

9 MARKET OPPORTUNITIES & TRENDS

9.1 TECHNOLOGICAL ADVANCES IN TRACTOR TECHNOLOGY

9.1.1 GPS TECHNOLOGY

9.1.2 HIGH DEMAND FOR AUTONOMOUS OR SELF-DRIVING TRACTORS

9.2 SHORTAGE OF AGRICULTURAL LABORERS

9.3 INCREASING USE OF BIOENERGY IN AGRICULTURAL MACHINERY

10 MARKET GROWTH ENABLERS

10.1 ASSISTANCE TO FARMERS THROUGH LOANS & SUBSIDIES

10.2 STRONG AGRICULTURAL COMMODITY PRICES SUPPORT MARKET

10.3 GROWING FOOD CONSUMPTION & EXPORT OF ORGANIC PRODUCTS

11 MARKET GROWTH RESTRAINTS

11.1 LACK OF AWARENESS OF LATEST AGRICULTURAL EQUIPMENT INNOVATIONS

11.1.1 LACK OF EDUCATION AMONG FARMERS

11.2 HIGH DEMAND FOR USED & RENTAL TRACTORS

11.3 CLIMATE CHANGE ADVERSELY IMPACTING AGRICULTURAL ACTIVITIES

12 MARKET LANDSCAPE

12.1 MARKET OVERVIEW

12.2 MARKET SIZE & FORECAST

12.3 FIVE FORCES ANALYSIS

12.3.1 THREAT OF NEW ENTRANTS

12.3.2 BARGAINING POWER OF SUPPLIERS

12.3.3 BARGAINING POWER OF BUYERS

12.3.4 THREAT OF SUBSTITUTES

12.3.5 COMPETITIVE RIVALRY

13 BY HORSEPOWER

13.1 MARKET SNAPSHOT & GROWTH ENGINE

13.2 MARKET OVERVIEW

13.3 LESS THAN 50 HP

13.3.1 MARKET OVERVIEW

13.3.2 MARKET SIZE & FORECAST

13.3.3 MARKET BY GEOGRAPHY

13.4 50 HP-100 HP

13.4.1 MARKET OVERVIEW

13.4.2 MARKET SIZE & FORECAST

13.4.3 MARKET BY GEOGRAPHY

13.5 ABOVE 100 HP

13.5.1 MARKET OVERVIEW

13.5.2 MARKET SIZE & FORECAST

13.5.3 MARKET BY GEOGRAPHY

14 BY WHEEL-DRIVE

14.1 MARKET SNAPSHOT & GROWTH ENGINE

14.2 MARKET OVERVIEW

14.3 2-WHEEL-DRIVE

14.3.1 MARKET OVERVIEW

14.3.2 MARKET SIZE & FORECAST

14.3.3 MARKET BY GEOGRAPHY

14.4 4-WHEEL-DRIVE

14.4.1 MARKET OVERVIEW

14.4.2 MARKET SIZE & FORECAST

14.4.3 MARKET BY GEOGRAPHY

15 GEOGRAPHY

15.1 MARKET SNAPSHOT & GROWTH ENGINE

15.2 GEOGRAPHIC OVERVIEW

15.3 FRANCE

15.3.1 MARKET OVERVIEW

15.3.2 LAND HOLDING STRUCTURES IN FRANCE

15.3.3 MARKET SIZE & FORECAST

15.3.4 BY HORSEPOWER

15.3.5 BY WHEEL-DRIVE

15.3.6 MARKET SHARE ANALYSIS

15.4 GERMANY

15.4.1 MARKET OVERVIEW

15.4.2 LAND HOLDING STRUCTURES IN GERMANY

15.4.3 MARKET SIZE & FORECAST

15.4.4 BY HORSEPOWER

15.4.5 BY WHEEL-DRIVE

15.4.6 MARKET SHARE ANALYSIS

15.5 ITALY

15.5.1 MARKET OVERVIEW

15.5.2 LAND HOLDING STRUCTURES IN ITALY

15.5.3 MARKET SIZE & FORECAST

15.5.4 BY HORSEPOWER

15.5.5 BY WHEEL-DRIVE

15.5.6 MARKET SHARE ANALYSIS

15.6 UK

15.6.1 MARKET OVERVIEW

15.6.2 BREXIT IMPACT ON UK AGRICULTURAL INDUSTRY

15.6.3 LAND HOLDING STRUCTURE IN UK

15.6.4 MARKET SIZE & FORECAST

15.6.5 BY HORSEPOWER

15.6.6 BY WHEEL-DRIVE

15.6.7 MARKET SHARE ANALYSIS

15.7 POLAND

15.7.1 MARKET OVERVIEW

15.7.2 LAND HOLDING STRUCTURES IN POLAND

15.7.3 MARKET SIZE & FORECAST

15.7.4 BY HORSEPOWER

15.7.5 BY WHEEL-DRIVE

15.7.6 MARKET SHARE ANALYSIS

15.8 SPAIN

15.8.1 MARKET OVERVIEW

15.8.2 LAND HOLDING STRUCTURE IN SPAIN

15.8.3 MARKET SIZE & FORECAST

15.8.4 BY HORSEPOWER

15.8.5 BY WHEEL-DRIVE

15.8.6 MARKET SHARE ANALYSIS

15.9 OTHERS

15.9.1 MARKET OVERVIEW

15.9.2 MARKET SIZE & FORECAST

15.9.3 BY HORSEPOWER

15.9.4 BY WHEEL-DRIVE

15.9.5 MARKET SHARE ANALYSIS

16 COMPETITIVE LANDSCAPE

16.1 COMPETITION OVERVIEW

17 KEY COMPANY PROFILES

17.1 JOHN DEERE

17.2 CNH INDUSTRIAL

17.3 AGCO

17.4 KUBOTA

18 OTHER PROMINENT VENDORS

18.1 ZETOR POLSKA SP. Z.O.O.

18.2 MAHINDRA & MAHINDRA

18.3 ESCORTS

18.4 JCB

18.5 FOTON

18.6 MTW HOLDINGS

18.7 SDF

18.8 ARBOS GROUP

18.9 YANMAR

19 REPORT SUMMARY

19.1 KEY TAKEAWAYS

19.2 STRATEGIC RECOMMENDATIONS

20 QUANTITATIVE SUMMARY

20.1 MARKET BY GEOGRAPHY

20.2 MARKET BY HORSEPOWER TYPE

20.3 MARKET BY WHEEL-DRIVE TYPE

21 APPENDIX

21.1 ABBREVIATIONS

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Click Here to Contact Us

Call: +1-312-235-2040

+1 302 469 0707

Mail: [email protected]

Photo: https://mma.prnewswire.com/media/1981598/EUROPE_TRACTOR_MARKET.jpg

Logo: https://mma.prnewswire.com/media/818553/Arizton_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/arizton-estimates-the-sale-of-tractors-to-reach-200-thousand-units-in-europe-by-2028-john-deere-cnh-industrial-agco-and-kubota-are-the-major-vendors-demand-for-50-100-hp-tractors-likely-to-increase-301719356.html

View original content:https://www.prnewswire.co.uk/news-releases/arizton-estimates-the-sale-of-tractors-to-reach-200-thousand-units-in-europe-by-2028-john-deere-cnh-industrial-agco-and-kubota-are-the-major-vendors-demand-for-50-100-hp-tractors-likely-to-increase-301719356.html